There are 17 rare-earth elements on the periodic table. These exotically named metals possess unique properties that make them useful in a huge range of high-tech applications, from powerful electric motors in the latest and greatest EVs to speakers, aircraft, guidance systems and even MRI machines. While not necessarily hard to find, rare-earth metals are difficult to extract and process, work that, today, is almost completely done overseas, an issue one American company is tackling head on.

The People’s Republic of rare-earth elements

“China produces over 92% of permanent magnets today,” said Tom Schneberger in an interview with EV Pulse. He’s the CEO of USA Rare Earth, a company headquartered in Tampa, Florida that’s striving to secure a reliable and commercially viable domestic source of these critical materials.

China’s dominance in this field has obvious risks, a situation that Schneberger said is increasingly unpalatable for the U.S., EU and other major global regions. “And that’s before you take into consideration the fact that these magnets are also used in defense, planes and artillery, and guidance systems,” he added. A reliable local supply of rare-earth metals and the ability to process them at home is critical not just for a cleaner, greener future, but for national defense as well.

Underscoring the seriousness of the current situation, Schneberger explained that globally, more than half of rare-earth-metals production is in China. There’s an operational mine in Australia supplying these elements and one in California has been restarted, but more production will be needed, much more. Including their plans, all the other mines that have been announced and then some, Schneberger said that when they take the demand from outside China and extrapolate it to 2030 “there’s an over 40% undersupply,” a massive shortfall.

But availability isn’t the only issue. No matter where rare-earth materials are sourced, whether it’s Australia, the U.S. or elsewhere, around 92% of them are processed in China, with much of the remainder being handled in Japan and South Korea. This is another critical component of the rare-earths story.

A two-pronged approach

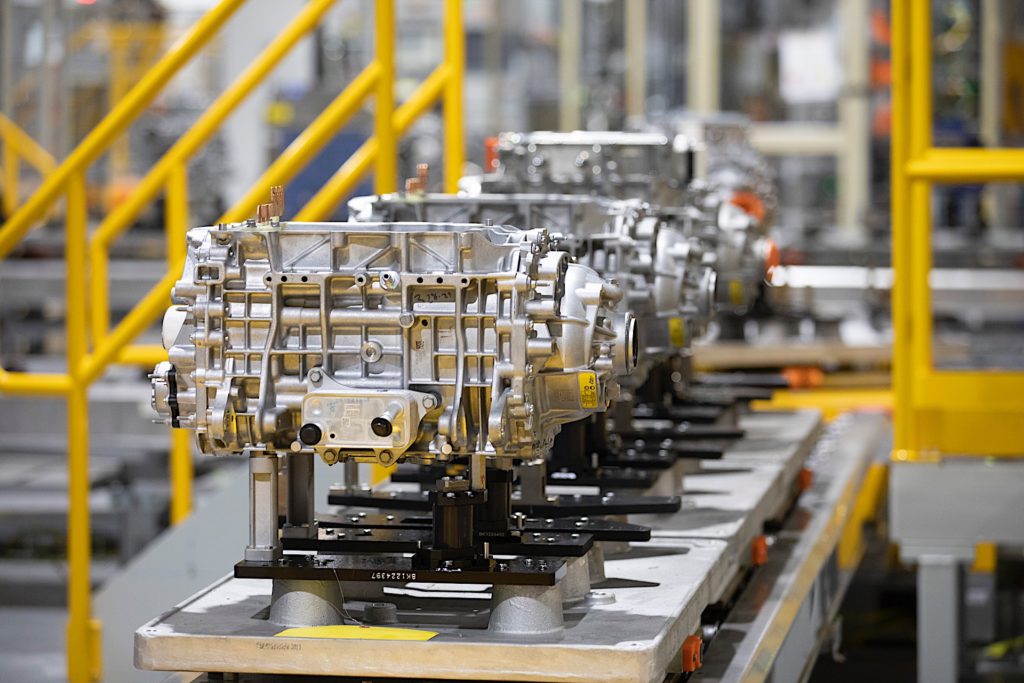

Addressing these deficits, USA Rare Earth is taking something of a two-pronged approach. Schneberger said that starting in 2024, they’ll begin manufacturing magnets at their production facility in Stillwater, Oklahoma using “materials purchased from outside China.” Then, by the latter half of 2025, the company aims to start producing its own rare-earth metals, mining and refining these materials locally, ultimately turning them into powerful magnets.

Jumpstarting these efforts, USA Rare Earth purchased mothballed assets — including their Oklahoma manufacturing facility — that were used to produce these materials in the past, before everything was outsourced to China. Additionally, they’ve secured access to a source of rare-earth elements in western Texas, near El Paso. Used as a beryllium mine in the past, the Round Top deposit is also located on state land, which dramatically streamlines the permitting process.

Making this mineral deposit nearly ideal, Schneberger explained it’s rich with rare earths, “… specifically the heavy rare earths, which give that unique property of maintaining the magnetism when it’s at high temperatures for applications like EVs.”

“[Rare earths] are generally split into two categories. People talk about light rare-earths and heavy rare-earths,” clarified Schneberger. “The most important light-rare earth as it relates to magnets is neodymium … [but] a lot of the light rare earths don’t have a lot of commercial value today. We’re fortunate in that this deposit is predominantly heavy rare earths,” which includes both dysprosium and terbium, but that’s not all.

A happy accident, “It is a multi-metallic deposit. There will be other products that we sell, including tech metals like gallium and hafnium … but also including lithium, as an example,” said Schneberger. “There’s a sizable amount of lithium in this deposit that we’re likely to partner with a company in order to make sure we get the value out of that.” Of course, lithium is a hot commodity these days, powering all kinds of electronic devices, though mountains of the stuff is used in EV batteries.

A rich source of rare earths and other elements, Schneberger said the Round Top deposit is expected to remain in production for 70 years, possibly even a century. Over its lifespan, the site is expected to yield some 1.2 million metric tons of rare-earth elements and around 500,000 metric tons of lithium.

Clean processing paired with local production

Of course, many more tons of rock and ore need to be handled and processed to yield these coveted materials, something USA Rare Earth will do in an eco-friendly way. “When we extract the rare earths here, we’re going to do it differently than the current mines are doing it,” said Schneberger. Other producers use solvent-based extraction, though USA Rare Earth is going with continuous ion exchange, a clean, closed-loop process. He added that extraction technologies have to be matched up to the characterization of the materials being treated. Since they’re working predominantly with heavy rare-earth elements opposed to lighter ones, this refining process is ideal.

On the production side of the equation, USA Rare Earth is expected to start delivering 600 metric tons of magnets annually, ramping up to full capacity of 1,200. Afterwards, Schneberger said they’ll mimic that line, duplicate it to get production up to 4,800 metric tons per year, all out of their Oklahoma facility. But even at that level, production “is only a single digit percent of the market. And we can already see as automotive customers are talking to us, that we’re going to have to ramp up quicker, and others will as well,” he added.

Powering the future

Naturally, car manufacturers are interested in the work USA Rare Earth is doing, and the company is in discussions with multiple automakers right now. Schneberger said they’re in talks with the U.S. military as well.

The supply of rare-earth elements hasn’t necessarily been an issue yet, but there are huge risks. The need to add some diversity to the supply chain is critical, something all kinds of manufacturers learned during the COVID-19 pandemic. “I don’t expect that it has to become perfect, that outside of China can supply itself wholly,” said Schneberger, but the looming deficit of these materials is massive, “and we’re going to need more than the people who’ve announced in order to … solve this problem.” If all goes according to plan, USA Rare Earth should play a crucial role in addressing this global issue.

Updated (11:50 a.m. Eastern, 6/15/2023): USA Rare Earth clarified that estimated magnet production figures are annual numbers, not daily as initially stated.